Overall, it’s a challenging market environment, and unfortunately it’s probably a better one for traders than investors, which makes it hard for TSP investors.

Overall, it’s a challenging market environment, and unfortunately it’s probably a better one for traders than investors, which makes it hard for TSP investors.

Lyn Alden

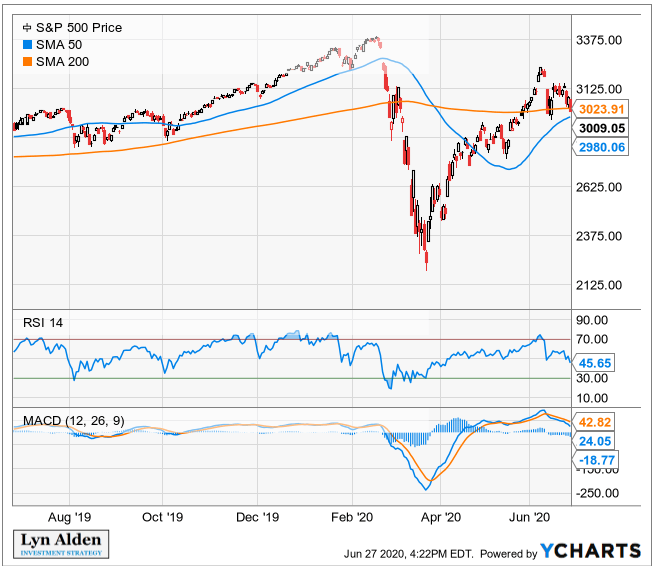

Equity markets, especially in the United States, have been on a bull run since the late-March bottom, as a variety of fiscal and monetary stimulus programs came online to counteract an otherwise deflationary and insolvency-producing economic shock.

In fact, the S&P 500, which the C Fund tracks, briefly turned positive for the year in early June after such a strong recovery rally, before rolling back over in recent weeks:

I highlighted this potential summer slump in last week’s article, and have been showcasing since early June the enthusiasm of small retail traders to drive the market up to caution-inducing heights. The market is now grappling with those forces, in a heightened phase of volatility.

The Recession and the Pandemic

A common depiction in the media is that the global economy was humming along fairly well, until this COVID-19 pandemic messed everything up.

However, the global economy has been slowing in rate-of-change terms since late 2018.

Back in August 2019, I wrote an article here on FEDweek called, “The Risk for a Recession is Rising, But the Future is Never Certain”, which discussed slowing economic indicators and suggested that TSP investors make sure their portfolios are risk-appropriate for their own unique situations, after a 10-year bull market.

In that article, I shared a custom heatmap that I use, which tracks various economic indicators in year-over-year percent-change terms. It shows how strong the U.S. growth cycle reached in 2017 and 2018 (plenty of green), and how slow it had become in mid-2019 (more signs of orange and red), including a decline in exports and construction spending, and an inverted yield curve:

Chart Source: Lyn Alden, with public data from the Department of Commerce, Department of Labor, and U.S. Federal Reserve

I’ve been tracking that heatmap regularly for research clients, and here’s the latest version as of June:

Chart Source: Lyn Alden, with public data from the Department of Commerce, Department of Labor, and U.S. Federal Reserve

So, after a broad-based slowdown in 2019, we had a severe drop-off in economic activity in Q1 2020 from the pandemic, and are starting to see some potential early signs of a rebound in May in rate-of-change terms. I’ll continue to monitor these develops as they come.

Overall, it’s a challenging market environment, and unfortunately it’s probably a better one for traders than investors, which makes it hard for TSP investors. This is because equities are highly-valued by most metrics, with the major S&P 500 index currently around the levels it reached in late 2019, despite the biggest negative impact to unemployment and the broad economy in the post-WW2 era.

At the same time, bonds and cash offer historically low yields, which is another way of saying that bonds are also very expensive. There’s plenty of volatility for traders to work with, but it’s hard for stocks to just keep smoothly grinding higher from current high levels for investors.

A diversified portfolio, such as the types offered by the Lifecycle Funds, can provide fairly balanced returns, although we may very well be in a low return environment overall.

Is the TSP Headed for a Summer Slump? (June 22)

TSP and Other Tax Considerations Ahead of July 15 Deadline

Lyn Alden is a financial writer and an engineer, and holds a bachelor’s in engineering and a master’s in engineering management, with a focus on financial modeling and resource management. She specializes in analyzing and presenting financial data. Her investment work can be found on LynAlden.com.

"correct" - Google News

June 29, 2020 at 10:20PM

https://ift.tt/31oWFlv

TSP: Equity Markets Continue to Correct and Consolidate to the Downside - FEDweek

"correct" - Google News

https://ift.tt/3d10rUK

https://ift.tt/35qAk7d

Bagikan Berita Ini

0 Response to "TSP: Equity Markets Continue to Correct and Consolidate to the Downside - FEDweek"

Post a Comment